Our mission is to teach a proven system and to provide traders with the tools to master it.

Peter Stolcers, founder

Your Success Is All That Matters

If you want to learn how to trade, you’ve come to the right place. It won’t be an easy journey, but we have everything you need. Our members are living proof that this system can be learned and replicated.

Others have gone through the process and so can you.

Review these testimonials from members who have learned our system and dramatically improved their win rate. Click on their photos and see what they have to say. Click here to refresh for new testimonials.

Here's What We Traded Recently

This is a simplified preview of our chat room last week. Notice that many traders are posting great stocks and the action is widespread. We are a laser-focused community trading a systematic approach.

Grouped By Trader

Notifications

your_Username

Active

Resources

Bookmarked Messages

Daily Bulletins

New Features On Option Stalker Pro

Advance Your Trading With Modern Tools

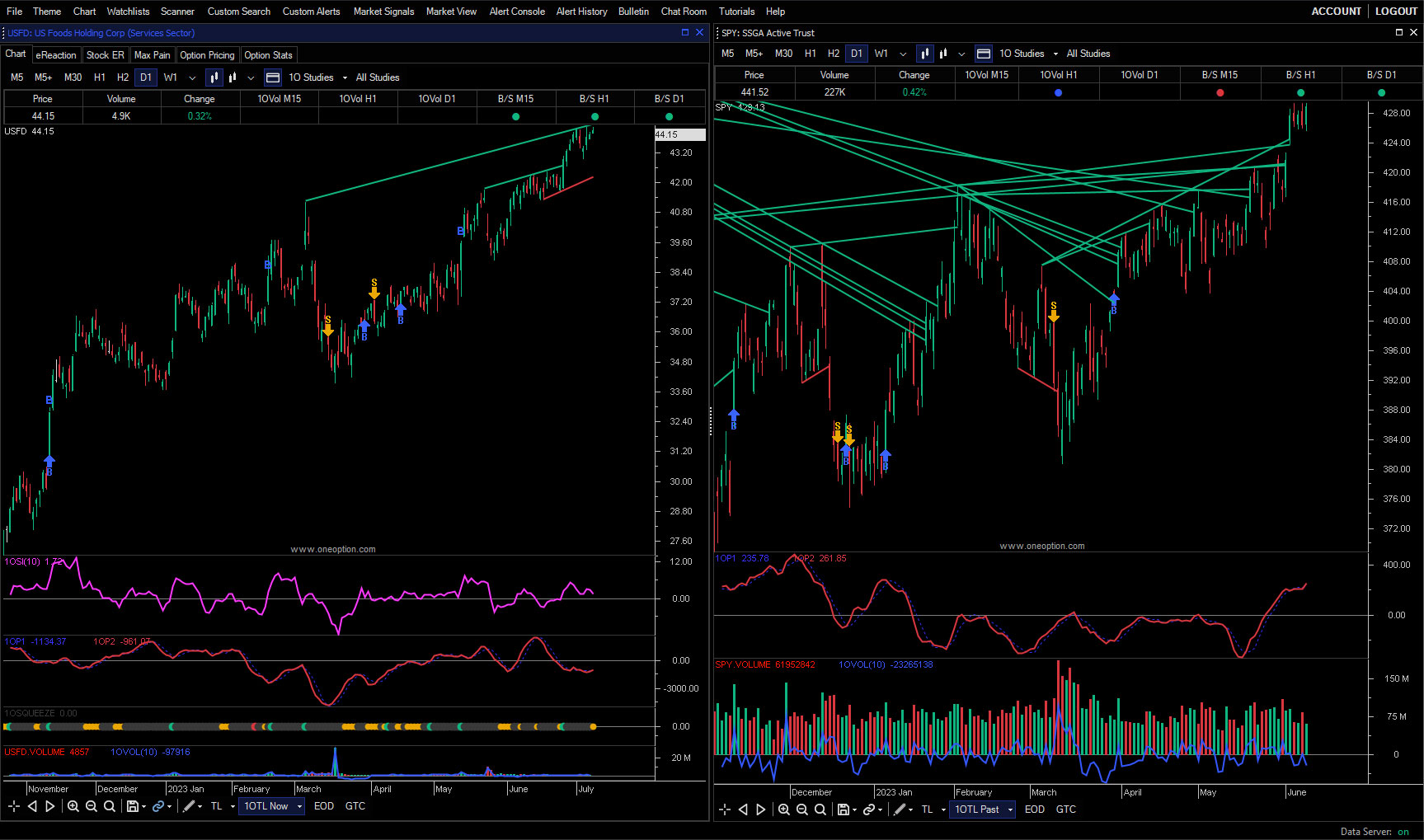

Automated Trendlines

Introducing our game-changing feature: Automated Trendlines. Say goodbye to manual chart drawing and hello to precision trading. With our cutting-edge rules, Option Stalker Pro automatically draws key trendlines on daily stock charts to help you track key levels of support and resistance monitored by institutional investors. Experience the ease and effectiveness of effortlessly tracking these levels to stay in sync with the Smart Money to advance your trading potential.

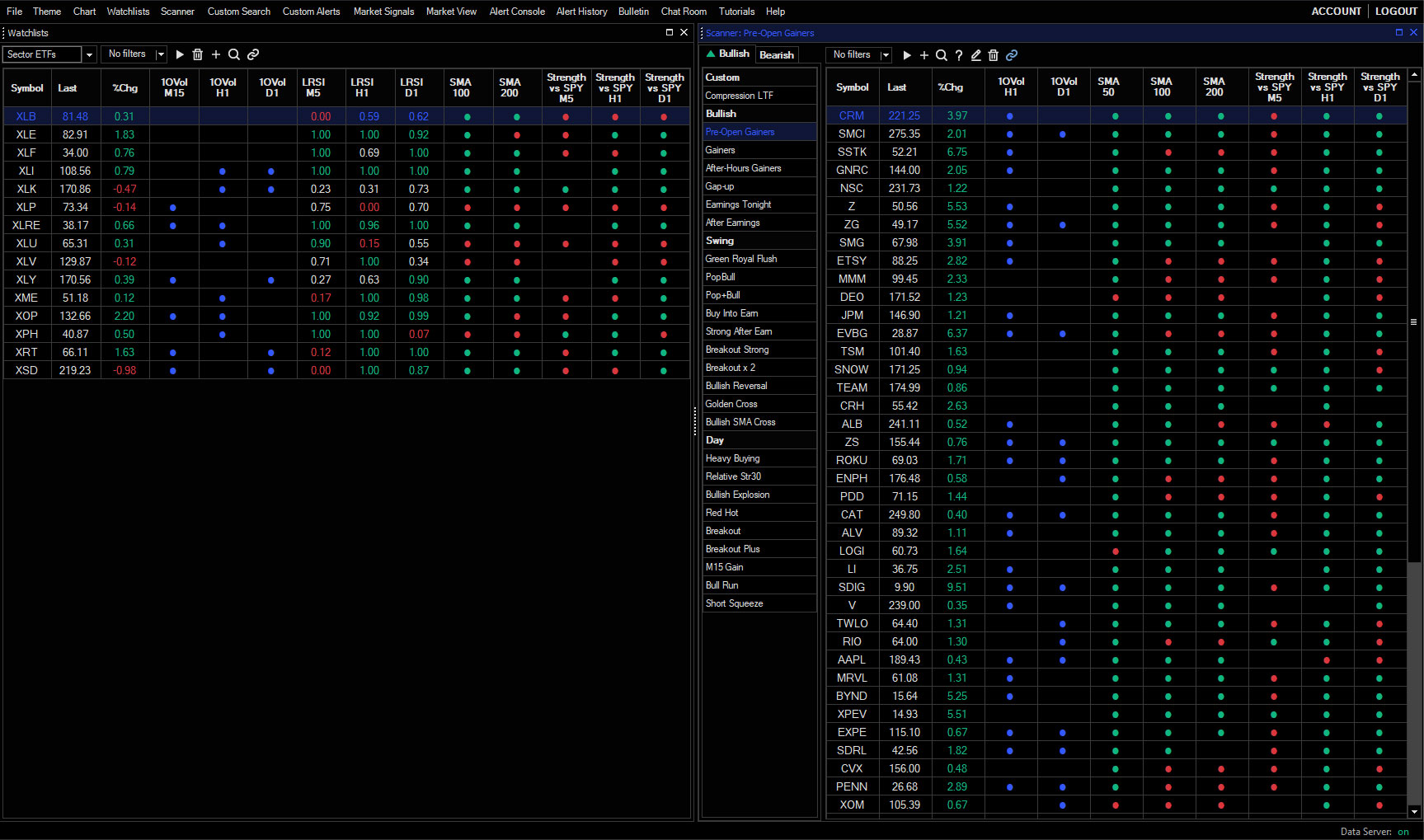

Custom Table Columns

Boost your trading with Custom Table Columns and unlock unparalleled customization capabilities. With this new feature, you have the power to tailor the columns on your scanners and watchlists to your exact specifications. Seamlessly include indicator values for multiple timeframes like Trade Signal (B/S), Strength vs SPY, LRSI, 1OVol, and daily SMAs to instantly grasp the Relative Strength/Weakness of a stock in a single glance, without diving into charts right away to make swift, informed stock selection decisions.

Rich Indicator Alerts

Experience the power of Rich Indicator Alerts, the ultimate tool for optimizing your trade entry and management. With this groundbreaking feature, you have the ability to create custom alerts based on stock indicator values, tailored to your unique trading strategy. Set up alerts that trigger on advanced indicator values, allowing you to stay one step ahead of the market. Whether it's multiple rules or multiple symbols, this feature offers unparalleled flexibility. Build alerts effortlessly from a list or chart, empowering you to closely track a stock and patiently wait for the perfect conditions to align and take control of your trading success like never before.

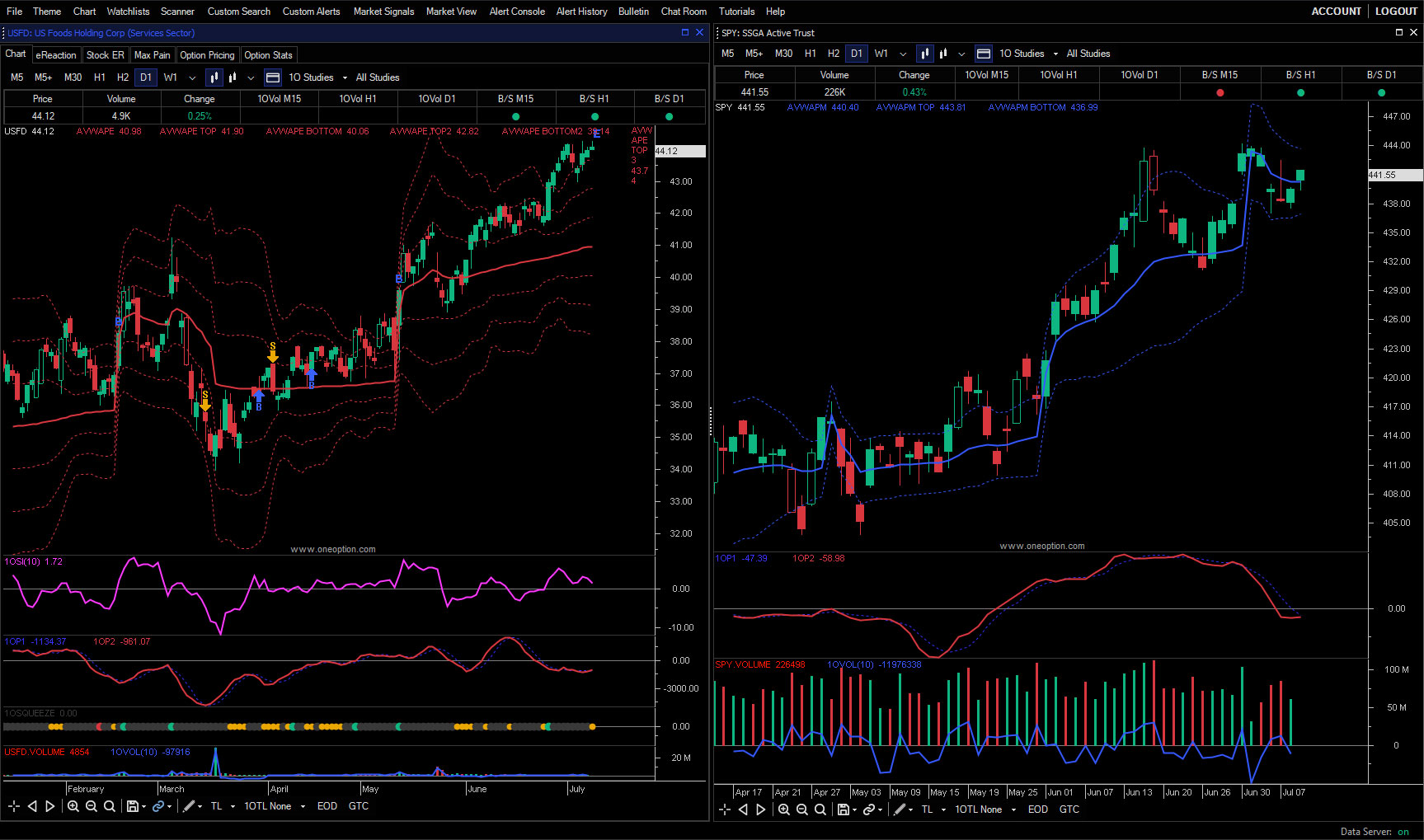

AVWAP Institutional Analysis

Stay ahead of the game and make informed trading decisions by harnessing the insights provided by AVWAP. This indicator, Anchored Volume Weighted Average Price, allows you to anchor VWAP at custom locations or significant dates, such as the start of the month, quarter, or earnings releases. By doing so, you gain access to crucial price levels closely monitored by institutional investors. For day traders who track institutional money and seek to capitalize on relative strength and weakness, these price levels are indispensable considerations. Elevate your trading strategy and align yourself with the forces shaping the market landscape.

The system works

Market Analysis and Stock Picks

We record two free YouTube videos each week that start with a review of the prior “pick of the day” and evaluate the trade, then conduct market analysis using Option Stalker Pro to find a new “pick of the day”. Click below to view recent videos.

How To Get Started:

Learn The System

Our trading system is your path to clarity and the Start Here section of our website will quickly get you up to speed. Each resource is an important building block. When you have reviewed the materials you’ll understand what the system is, why it works and the tools we use to find opportunities. The effort you put into learning the system and the tools is critical. Don’t rush the process. Armed with knowledge, you’ll be ready to see the system in action.

Meet The Traders

It’s time to register for the Free Trial. The action will be fast and furious. You’ve studied the patterns so you’ll understand the basis for each trade posted in the chat room. You’ll have access to Option Stalker Pro. It has an incredibly powerful search engine and is the source of all of our trade ideas. The two-week trial will fly by so please make sure that you are prepared. We want you to maximize it.

Join Us

You are going to learn more than you can imagine in a very short period of time. The traders you meet during the free trial started right where you are now. You’ll see them enter and exit great trades with ease and they are living proof that this system can be learned and replicate. We’re confident you’ll want to join our team and we’ll help you find the product that suits your needs.

The best way to get started is to read through the entire website. We’ve included an incredible amount of educational content to teach our systematic approach. You’ll know what it is, why it works and how our tools help you exploit the edge that we trade. The Start Here section will lead you through the process step-by-step.

I have to answer this question with a question. Do you trust track records? We don’t because many of these so-called track records are “cherry-picked.” We offer many ways for you to check our performance.

- During your free trial ask members in the chat room if they are making money. We don’t mind if you do this and we won’t interfere when members respond.

- Watch the trades in the chat room during the free trial.

- Watch the YouTube videos. In each daily video we recap the trades highlighted in the prior video. Go back weeks or months and watch those videos. In fact, check the YouTube videos that were posted during the biggest market crash since the Great Depression

We don’t want to win you over with old trades. We want to show you how we are making money today. That’s why we offer a free two-week trial. Visit Start Here to learn how to begin.

You will find a detailed comparison of our products and features on the Pricing Page.

We suggest starting with a shorter term subscription because we do not offer refunds. If you like our trading technology after using it for a month or two, subscribe to a longer term and save money. The days you have left on the old subscription will be added to the new subscription.

Visit the product pages for Chat Room, Option Stalker, and Option Stalker Pro. They describe everything you need to know to get started using our tools. Additionally, please visit the Pricing Page for a side-by-side feature comparison. Option Stalker Pro is our flagship product and we suggest you read it’s dedicated page and manual carefully to understand it and the system we trade. Together, we highlight all of the features and describe the searches and when to use them and it explains the search variables offered in Custom Search.

In short, if you are an active trader you will want Option Stalker Pro.

Yes. We have an extensive library of articles located under The Edge in the top menu. You can find step-by-step instructions on how to explore our website in the Start Here page. Please begin with Our Trading Methodology. We suggest that you read as many of these articles as possible. Some of them are available to the public and some are only available to paid members. You will also find educational videos and our eBook. Annotated charts are posted to the chat room to highlight specific trading patterns. In short, everything OneOption touches has an element of education.

Learn The System

Start With OneOption, free.

Start Free TrialNo subscriptions. No annual fees. No lock-ins.